39+ deducting mortgage interest from taxes

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Homeowners who are married but filing.

Can I Deduct Mortgage Interest On My Taxes Experian

If so you must.

. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. 750000 if the loan was finalized. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

Web 2 days agoYou can however in the US. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web Most homeowners can deduct all of their mortgage interest.

Sponsored Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. According to the Internal Revenue Service IRS US. Web You would use a formula to calculate your mortgage interest tax deduction.

Homeowners who bought houses before. Web 2 days agoThe entirety of the mortgage interest can be deducted if it fits into at least one of this three categories. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web If your home was purchased before Dec. For tax years before 2018 the interest paid on up to 1 million of acquisition.

Web 28 Likes 17 Comments - Elissa Berkoff Realtor Milwaukee Metropolitan Area elissaberkoffrealestate on Instagram. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the.

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. No Tax Knowledge Needed. If youre in a position to buy a home.

TurboTax Makes It Easy To Get Your Taxes Done Right. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. Mortgages taken out before October 13 1987 also known as.

Sponsored Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. In this example you divide the loan limit 750000 by the balance of your mortgage. Web How Much Mortgage Interest Can I Deduct.

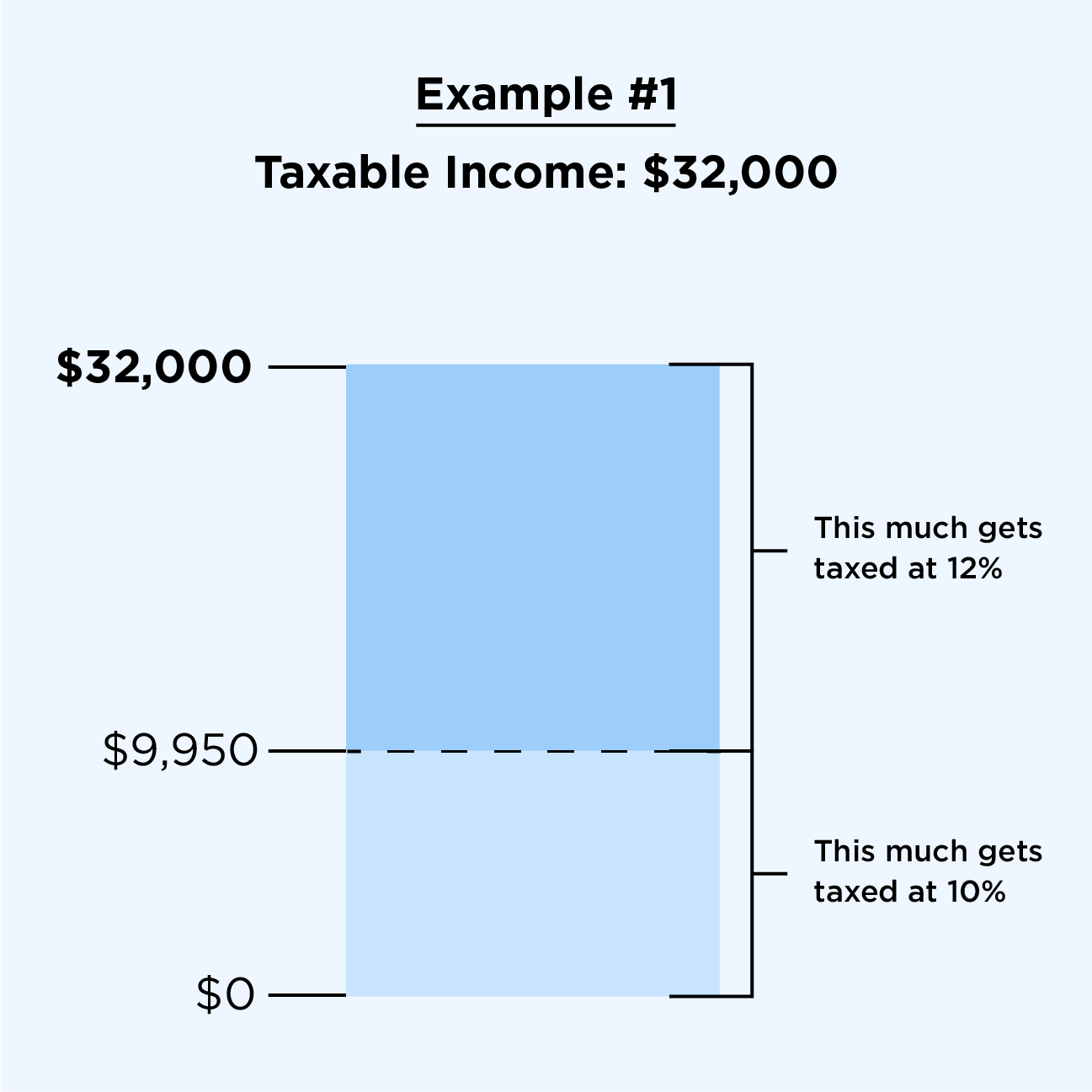

Web Up to 96 cash back You might qualify for real estate tax deductions if you pay mortgage interest in advance for a period that goes beyond the end of the tax year. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to.

16 2017 then its tax-deductible on mortgages. Web March 4 2022 439 pm ET. Sponsored File 1040ez Free today for a faster refund.

Web Up to 96 cash back You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as. Web The IRS places several limits on the amount of interest that you can deduct each year.

However higher limitations 1 million 500000 if married. Homeowners can deduct home mortgage interest on the first 750000 375000.

Property Tax How To Calculate Local Considerations

Tax Planning For Beginners 6 Tax Strategies Concepts Nerdwallet

What You Need To Know About Self Employment Tax 2023

Free 39 Sample Budget Forms In Pdf Excel Ms Word

Deducting Mortgage Interest Expat Tax Professionals

Free 39 Estimate Forms In Pdf Ms Word

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Free 10 Sample Quitclaim Deed Forms In Pdf Ms Word

Amazon Com Egp Irs Approved 1098 Laser Set Mortgage Interest Tax Forms For 50 Recipients Tax Record Books Office Products

Nowly Insurance Review Loans Canada

Types Of Taxes Income Property Goods Services Federal State

Mortgage Interest Deduction Bankrate

:max_bytes(150000):strip_icc()/high-school-students-5bfc2b8b46e0fb0083c07b7d.jpg)

Mortgage Interest Deduction

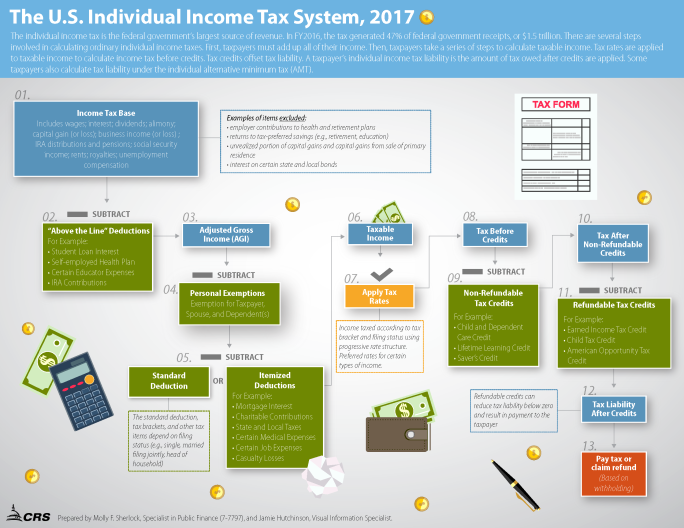

The Federal Tax System For The 2017 Tax Year Everycrsreport Com

Calculating The Home Mortgage Interest Deduction Hmid

India Herald 082714 By India Herald Issuu

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News