26+ Navy federal personal loan

AFCC BBB A Accredited. CLOC repayment terms are 2 of the outstanding balance or 20.

See My New Video I Made Today Credit Karma Credit Card Limit Im App

Credit score None See my rates on NerdWallets secure website Pros Cons Pros No.

. National Debt Relief is Our Highest Rated Debt Consolidatoin Loan Company on All Criteria. Go the Navy Federal Credit Union website and visit the personal loan page. Navy Federals rates vary depending on your term length the model year of your car and the number of miles on the vehicle.

Ad Free Independent Reviews Ratings. Our Certified Debt Counselors Help You Achieve Financial Freedom. A business checking line of credit CLOC is a credit product with a fixed rate of 179 APR.

Navy Federal offers various affordable Payment Protection Plan options. How long does loan approval Take Navy Federal. Navy Federal offers personal loans with APRs of 819 to 18.

See If You Qualify. Navy Federal Credit Unions personal loan requirements include being at least 18 years old having enough income or assets to make the monthly payments and having a Social. Serving the Navy Army Marine Corps Air Force Veterans and DoD.

Call us at 1-888-842-6328. Ad Loans from 600 to 100000. Apply for a Consultation.

Fast and free to get your personalized rates. Navy Federal Credit Union We serve where you serve. While their minimum APR is higher than the lowest rate possible on most personal loans their.

Navy Federal Credit Union Personal Loan Est. Editorial and user-generated content is not provided reviewed or. Loans Credit Cards Navy Federal Credit Union Loans Credit Cards Our convenient application process makes it easy to get a loan at a great rate or a credit card with exclusive benefits.

At Navy Federal members can request a personal loan of 250 to 50000 with an APR that starts at 749 for a loan term of up to 36 months 1479 for 37 to 60 months and. Start Easy Request Online. Get a Savings Estimate.

If youre a member of the Navy Federal you can apply for a personal loan in four easy steps. A loan amount of 5000 for 36 months has a payment range from 156 to 183 and finance charge range from. Ad Get Your Financial House In Order Without Bankruptcy or Loan.

APR 749-1800 Loan amount 250-50000 Min. Ad One Low Monthly Payment. Rated 1 by Top Consumer Reviews.

Join 2 Million Residents Already Served. See if you prequalify for personal loan rates with multiple lenders. New cars have the lowest rates.

With Payment Protection your Navy Federal loan or credit card balances will be cancelled in the. How do I check my loan status with Navy Federal. Personal Loan rates range from 749 to 1800 APR.

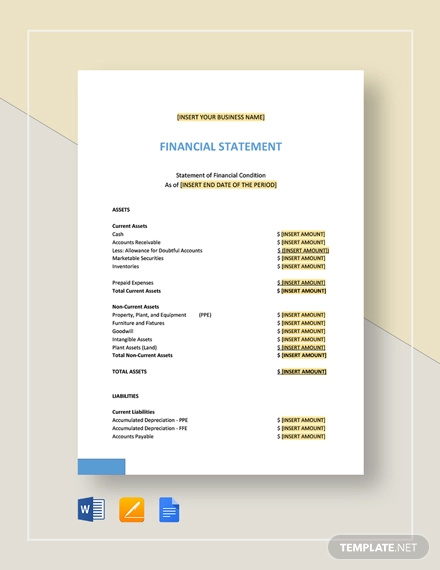

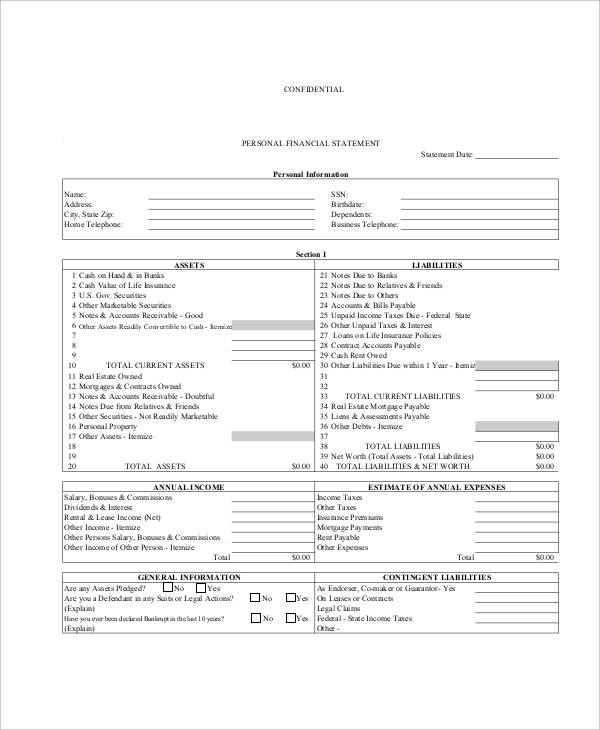

35 Financial Statement Examples Annual Small Business Personal Examples

Navy Federal Credit Union Statement Template Mbcvirtual In 2022 Navy Federal Credit Union Statement Template Credit Card Statement

How Much Does Each Division Of The United States Military Pay Each Member Quora

All Loan Home Loan Personal Loan Loan Against Property Business Loan Easy Loan Rate Off Interest Home Home Loans Loan Interest Rates Buying First Home

2

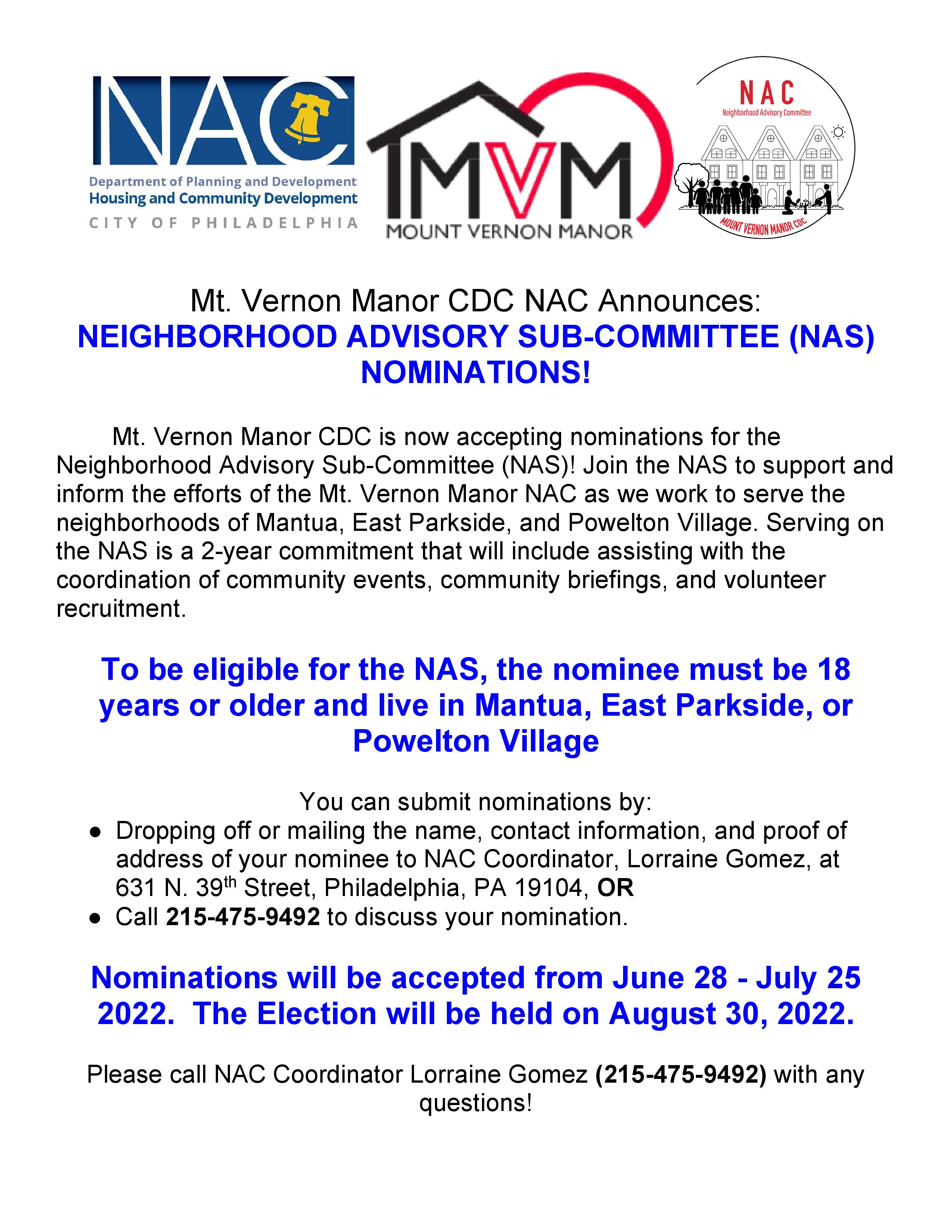

The Parkside Journal News That Is From About And Benefits Our Parkside Community In West Philadelphia

Navy Federal Credit Union Review Cover Letter Writing A Cover Letter Lettering

26 Notaries Open On Sunday Near Me Online Or Saturday S Too Frugal Living Coupons And Free Stuff

Visa Signature Flagship Rewards Credit Card Special Offer Navy Federal Credit Union Navy Federal Credit Union Federal Credit Union Rewards Credit Cards

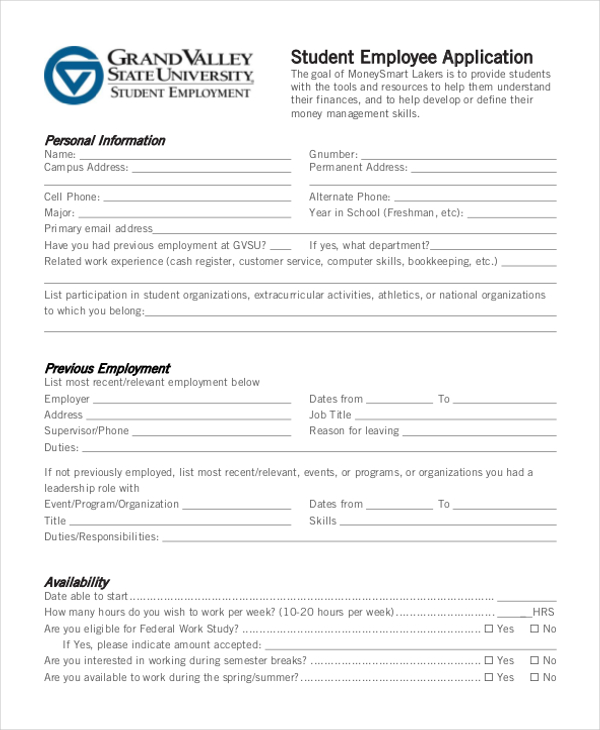

Free 13 Sample Employee Application Forms In Pdf Excel Ms Word

8 Awesome Navy Federal Credit Card Invitation Loan Interest Rates Loan Rates No Credit Loans

Mcu Municipal Credit Union Bank Statement Template Mbcvirtual In 2022 Statement Template Bank Statement Word Template

2

5nkfcnu4v5yk M

G146265mm05i014 Gif

35 Financial Statement Examples Annual Small Business Personal Examples

Credit Union Vs Bank The Differences Credit Unions Vs Banks Credit Union Marketing Credit Union